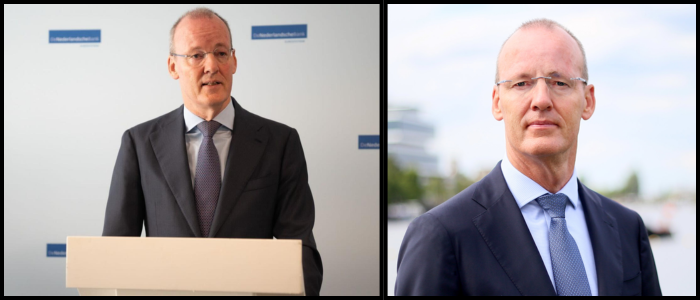

Knot spoke after interim Finance Minister Eelco Heinen said future DNB chiefs will have five-year, not seven-year, terms. Newish DNB president Olaf Sleijpen, who took office in September of last year, will get a full seven years, starting July 1, but Heinen had contended that lengthy appointments might contribute to "tunnel vision" and excessive dominance by leaders of the institution.

Knot: Longer terms necessary for global legitimacy and independence.

Knot also insisted that long terms should not become too long because you need a long time to establish credibility in international financial forums. "I just started as chair of the FSB last December — more than ten years after I entered DNB," he said. "If I could only stay two terms of five years, I never would've made it. Such jobs are important for safeguarding Dutch financial stability, he said, because risks frequently come from elsewhere.

He recognized challenges that long tenures bring, among them a management team largely handpicked by a single leader, but said that he has fostered internal pushback and transparency during his presidency. He cited an independent review of DNB's economic advisory role, and renovations to the bank's Amsterdam headquarters that was designed to open parts of the building to the public, as proof that the the bank valued openness.

Shorter term duration could expose it to political pressure, Knot warns

Knot emphasised the importance of long-serving terms in protecting the political autonomy of central banks. "Countries with high credit ratings typically have long terms of office in such a position," he observed, adding that independence is necessary to ensure economic stability and investor confidence.

He pointed to the U.S. back in the 1970s: Under pressure from President Nixon, Fed Chairman Arthur Burns kept interest rates low even as inflation inched up, producing stagflation. It was only years after that that Paul Volcker, his successor, restored economic equilibrium —at great social cost. "Unlikewise then, inflation has come down considerably now at much less cost because we kept the inflation expectations at anchor," Knot said.

He also maintained that the tenure trends among private companies should not be the model adopted for central banks. "The world of central banking is fundamentally different, and it's based on long-run credibility, seniority," he said.

As far as the toll that the work took on him, Knot acknowledged that it came at a price. "You are going into a deficit with your family — sometimes psychologically, sometimes physically," he said. He says he'll spend time looking back, starting July 1, but he notes, "I have no regrets — not for a moment."